Your cart is currently empty!

Sui is a decentralized permissionless smart contract platform based towards low-latency management of assets. It’s a new promising project with great opportunity to reach in top 10 crypto project, so it must be evaluated. to compare it with other chains read this.

| Mcap/TVL | 4.4 |

| Protocols | 40 |

| Stablecoin | $400M |

| Token Volume /Mcap | 8% |

| Volatility | 5% |

| Circulating | 27% |

| Monthly unlock | 0.8%-0.1% |

| unlock end | Mar 2030 |

| locked token | <20% |

SUI foundation

Foundation

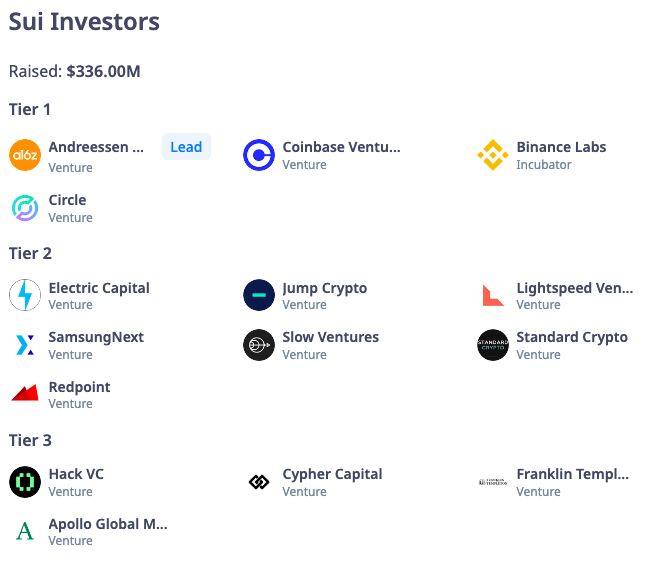

Corporate investors

Investors

TVL/Mcap around 25% is a good amount of TVL for a layer-1 chain, this shows a good demand for the token.

Active ecosystem with more than 40 protocols that is growing with a good rate, indicates good planning to develop its infrastructure.

The foundation run support program to cover its ecosystem, this will help better ecosystem growth. Developers are the heart of any ecosystem and any project who figure it out to incentivize them appropriately is in a right pass, and it seems SUI is in line.

Project developers claims transaction speed of 297,000 TPS in theoretical ofcourse, that is very faster than Solana (65,000 TPS in theoretical). This extraordinary speed could be a game changing for this project, if it becomes true.

These days supporting Zero-knowledge Protocol is becoming an important issue in web3 world, hopefully SUI support this tech.

It seems that SUI vesting didn’t cause any price fall like other token such as ARB, OP. It’s because the vesting amount is low and become lower during the time.

As we check SUI community it seems they couldn’t satisfy their community by airdrop. SUI community get airdrop for running nodes, that hardly cover their expenses.

Leave a Reply