Your cart is currently empty!

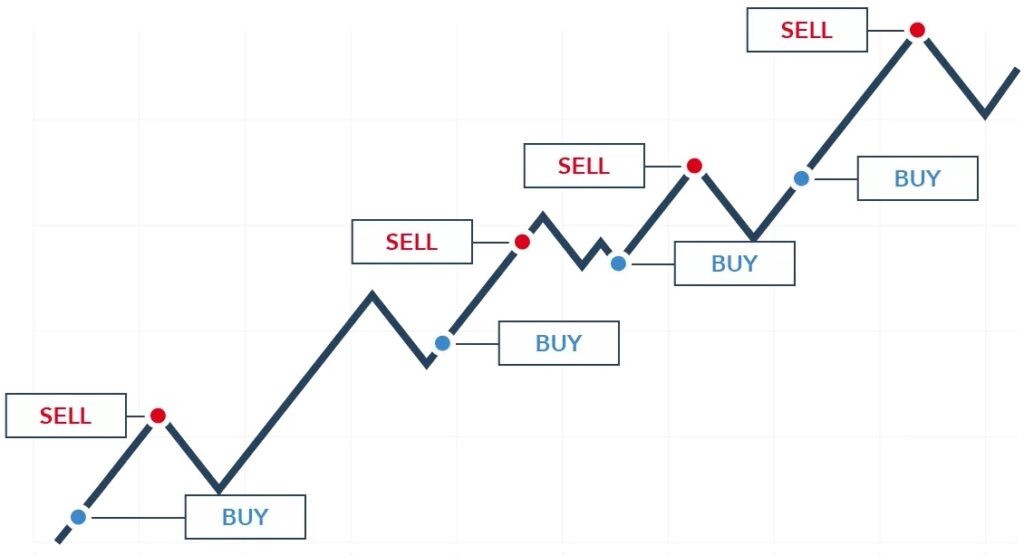

Buy the dip in uptrends

Buying the dip is an old strategy to increase asset, but you must watch out of trend and using this strategy in uptrend.

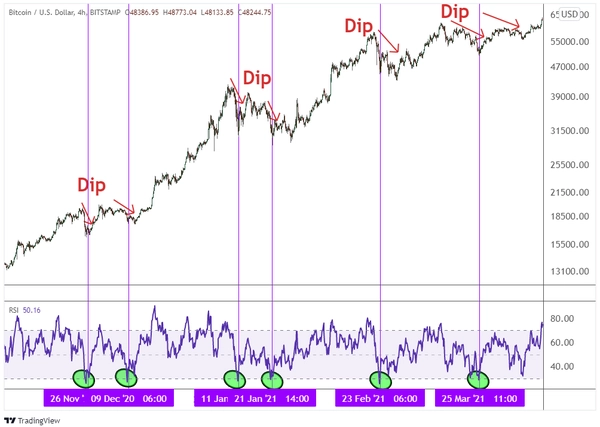

uptrend: draw a line to connect all Dip (you need at-least two point) this called trend-line, when its broke then uptrend has been finished. Buy the Dip in uptrends.

downtrend: If long-term trend changed to downtrend each dip means there may another dip out there.

draw a line to connect all High point (you need at-least two point) this descending line called downtrend, when it broke to up, it means downtrend has been finished.

Note: after breaking a trend line it doesn’t mean that trend has been changed! When we have two high or two low and the possibility of drawing a new trend line then we have a confirmation of trend.

Note: It’s better to use line chart instead of candle stick chart. The trend lines are more understandable in line chart.