Your cart is currently empty!

TOKEMI your Crypto Advisor

Here we introduce a crowd hedge fund that is accessible to everyone, with high quality investment data & research.

Here we introduce a crowd hedge fund that is accessible to everyone, with high quality investment data & research.

Crypto Investment is more profitable and more riskier than any other area. Don’t blindly walk into it. Get help from experts.

Portfolio Structure

Structuring a portfolio is an art of diversity, equity and inclusion based on Research , Risk parameters, Risk taking level, investment goals and Market forecasting.

Risk Management

Risk Management is the process of deals with a financial, legal, and strategic risk of portfolio assets and controlling the situation.

Emotion Control

Crypto Market is very high volatile, so it is very important for investors to control their emotion and act due to their strategy.

Portfolio Management

Managing a portfolio is a routine process for rebalancing asset allocation based on risk management strategy and strategic objectives.

Crisis Management

Crisis Management is the process of identifying and handling a disruptive and unexpected event that threatens to harm Market.

Patience, Patience, Patience

Get rich quick scheme are exist in crypto but very risky and the possibility of losing all you have is more than 99%, so be patience and grow slowly.

TokeMi research insight team identify high quality projects, evaluate protocols, analyze ecosystems, compare projects in targeted areas and study tokenomics.

You can check some of these reports. (disclaimer alert: Be aware that this is not an investment advise, do your own research, do your own move.)

$2T+

Market Cap

800+

Exchanges

$166B

Stablecoins

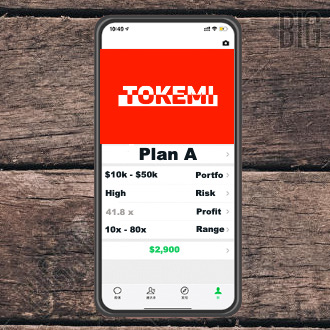

Plan A

Small Cap

($10k-$50k)

High Risk

Plan B

Medium Cap

($50k-$250k)

Medium Risk

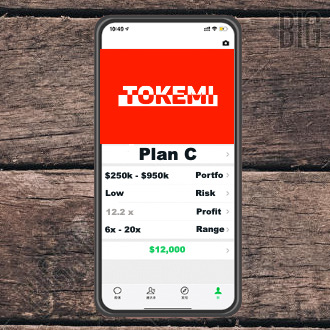

Plan C

Good Cap

($250k-$950k)

Low Risk

Plan D

Large Cap

($1M-$5M)

Very Low Risk

Special Service

Secure Portfolio Management using trade only API without withdraw/deposit access.

Limited Number (assign portfolio manager)

Success doesn’t happen in coincidence, let us guide you through this path.

We use “only trade APIs” that is provided by exchanges, so no one access to investor assets, withdraw, deposit or password. The only possibility is trade & asset allocation. We care about your safety.

If you’re only using our portfolio plans then you should know that they provided in excel to increase flexibility, so you can rebalance it as you wish.

We prefer protect our customers money, rather than make money. Hence we don’t like or recommend any meme, bubbles, even tech trends.

we share our research in public so if you want to do it all by yourself you could check them out, DYOR, and invest on assets you like.

None of our papers on tokemi.org have include any investment advise, we just research on projects, compare them and share some of our ideas & works.